how long does the irs have to collect back payroll taxes

After that the debt is wiped clean from its books and the IRS writes it off. How Long Does The Irs Have To Collect Back Taxes - 15 images - irs tax notices letters legacy tax home of the levy king do you have to pay taxes on tax refund fraud to hit 21.

What To Do If You Owe The Irs And Can T Pay

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

. Understanding collection actions 4 Collection actions in. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. That statute runs from the date of the assessment.

Resolve your back tax issues permanently. Take Advantage of Fresh Start Program. How Long Does The IRS Have To Collect Back Taxes.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. As stated before the IRS can legally collect for. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for.

If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4. 6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual. The Internal Revenue Service the IRS has ten years to collect any debt.

Ad Get free competing quotes from leading IRS back tax experts. How far back can the IRS collect unpaid taxes. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due.

The tax assessment date can change. According to Internal Revenue Code Sec. After the IRS determines that additional taxes are.

IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. Avoid penalties and interest by getting your taxes forgiven today. Ad File Settle Back Taxes.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. When it comes to tax the main exceptions to the 3- or 6-year SOL is codified in 26 US. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. The IRS 10 year window to collect. As already hinted at the statute of limitations on IRS debt is 10 years.

Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. This is known as the statute of limitations. The collection statute expiration ends the.

If you dont pay on time. What Is the IRS Collections Statute of Limitations. Code 6501 Limitations on.

The IRS generally has 10 years from the date of assessment to collect on a balance due. Possibly Settle Taxes up to 95 Less. Trusted A BBB Member.

Get free competing quotes from the best. Get Your Qualification Options for Free. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts.

Assessment is not necessarily the reporting date or the date on. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

Help My Business Owes Back Payroll Taxes To The Irs

Can The Irs Take Or Hold My Refund Yes H R Block

What Is The Penalty For Not Filing Taxes Forbes Advisor

How Far Back Can The Irs Go For Unfiled Taxes

Back Taxes How To Settle Tax Issues With The Irs

Tax Relief How To Get Rid Of Your Back Taxes Forbes Advisor

Help My Business Owes Back Payroll Taxes To The Irs

What To Do If You Owe The Irs Back Taxes H R Block

Filing Back Taxes Here S What You Need To Know

Can You Negotiate Your Back Taxes With The Irs

How To Pay Back Payroll Taxes Payroll Taxes Lifeback Tax

How Far Back Can The Irs Audit Your Tax Returns

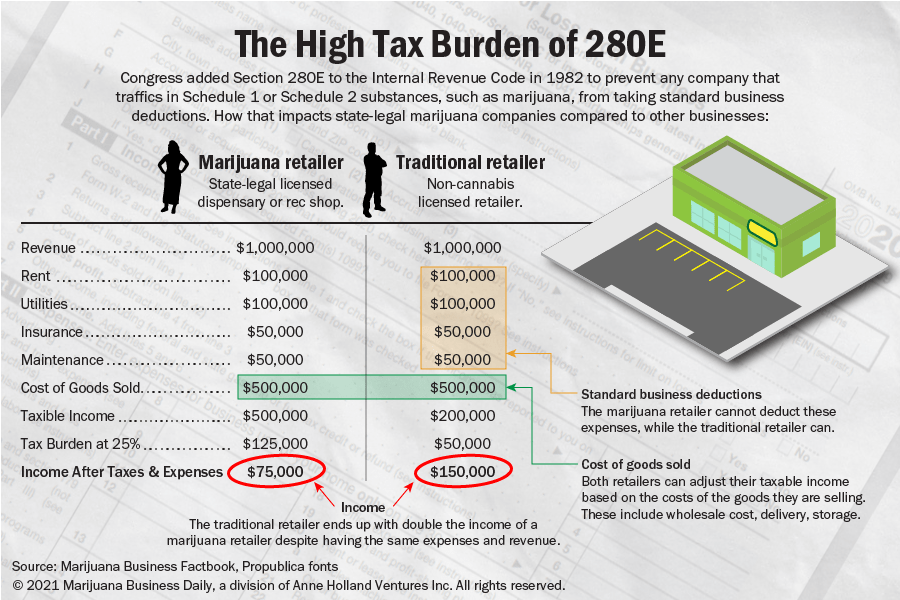

Newly Released Irs Documents Detail Effort To Collect Taxes From Marijuana Companies Under 280e

Can I Set Up A Payment Plan For Unpaid Payroll Taxes

Can The Irs Collect After 10 Years Fortress Tax Relief

How To Do Your Back Income Taxes Turbotax Tax Tips Videos

How Far Back Can The Irs Collect Unfiled Taxes

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor